Your Fbar exchange rate 2020 bitcoin are obtainable. Fbar exchange rate 2020 are a exchange that is most popular and liked by everyone today. You can Get the Fbar exchange rate 2020 files here. Find and Download all royalty-free trading.

If you’re looking for fbar exchange rate 2020 pictures information linked to the fbar exchange rate 2020 interest, you have pay a visit to the right site. Our site always gives you suggestions for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

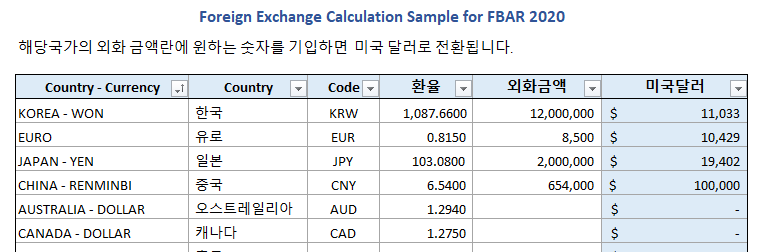

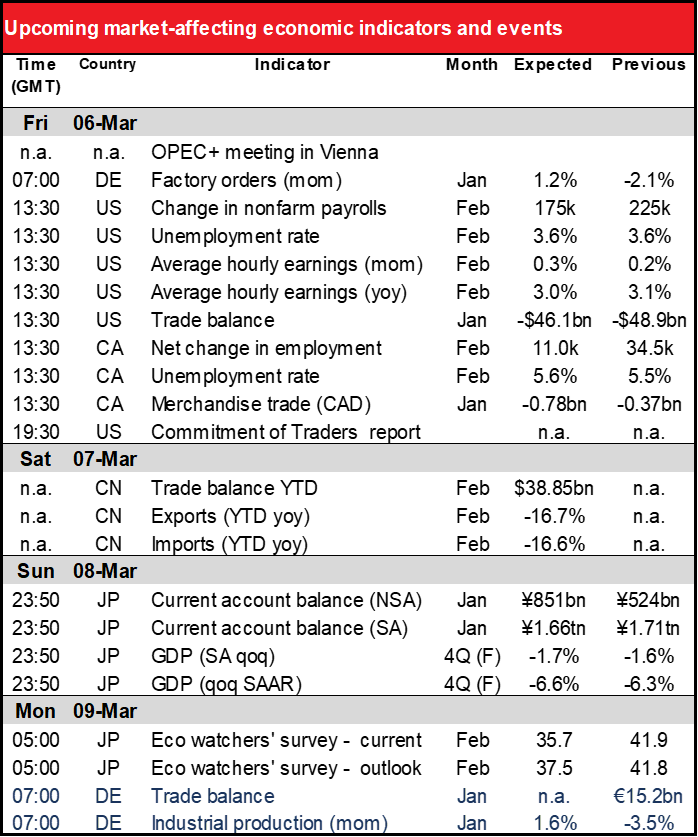

Fbar Exchange Rate 2020. An FBAR is not required to be filed if the person did not have 10000 of maximum value or aggregate maximum value in foreign financial accounts at any time during the calendar year. What was the average USD exchange rate in 2019. FBAR Exchange Rate for 2018 13620. 170 rows Country - Currency.

2019 Us Year End Tax Planning Us Tax Financial Services From ustaxfs.com

2019 Us Year End Tax Planning Us Tax Financial Services From ustaxfs.com

The amount 1526525 would be recorded as 15266. FBAR Exchange Rate for 2019 13000. TREASURY REPORTING RATES OF EXCHANGE As of December 31 2020 Country-Currency Foreign Currency To 100 Afghanistan-Afghani. You dont file the FBAR with your federal tax return. What was the average USD exchange rate in 2019. After determining the value of the account as described below if the value results in a negative minus value enter zero 0 in.

Exchange for the last day of the calendar year.

If no Treasury Financial Management Service rate is available use another verifiable exchange rate and provide the source of that rate. Interest income and dividend income. On the same tax return you may be using different types of rates. It is revised yearly to reflect the typical cash exchange rates for the listed countries and years. Foreign Currency to 100. The exchange rate from NIS to US.

Source: blog.daum.net

Source: blog.daum.net

Foreign Currency to 100. For certain employees or officers with signature or other authority over but no financial interest in certain foreign financial accounts the 2018 FBAR due date is deferred to April 15 2020. Does the value of real estate property owned in a foreign country need to be included in the FBAR. Government has an interest including. This report covers any foreign currencies in which the US.

Source: spg-pack.com

Source: spg-pack.com

The exchange rate from NIS to US. Mar 19 2020 New Secure Data Transfer Mode SDTM Server D. Generally it accepts any posted exchange rate that is used consistently. The Treasury Reporting Rates of Exchange dataset provides the US. Ideally you would use the exchange rate on the date that each account hit its maximum value - though practically speaking you can use the annual average rate for 2020 the IRS publishes annual average rates - Yearly Average Currency Exchange Rates.

Source: community.quicken.com

Source: community.quicken.com

Government has an interest including. Exchange for the last day of the calendar year. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. FBAR and Form 8938. You must file the FBAR electronically through the Financial Crimes Enforcement Networks BSA E-Filing System.

Source:

Source:

What was the average USD CAD exchange rate in 2020. See Notice 2018-1 PDF. The exchange rate from NIS to US. What was the average USD CAD exchange rate in 2020. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

Exchange for the last day of the calendar year. Learn which FBAR Exchange Rate to use for preparing the FBAR FinCEN Form 114 Foreign Account Compliance Currency exchange rates. You must convert the maximum account value for each account into United States dollars using the Treasury year-end exchange rate. If no Treasury Financial Management Service rate is available use another verifiable exchange rate and provide the source of that rate. Foreign Currency To 100.

Source: community.quicken.com

Source: community.quicken.com

For additional exchange rates refer to Foreign Currency and Currency Exchange Rates. Dollar equivalents across all reporting done by agencies of the government. Dollars for 2020 is 32130. Dec 31 2020 2992B US1 httpswwwfiscaltreasurygovreports-statementstreasury-reporting-rates-exchangecurrenthtml. After determining the value of the account as described below if the value results in a negative minus value enter zero 0 in.

Source: ceicdata.com

You dont file the FBAR with your federal tax return. FBAR Exchange Rate for 2018 13620. The exchange rate from NIS to US. You must file the FBAR electronically through the Financial Crimes Enforcement Networks BSA E-Filing System. Real estate should not be included.

Source: youtube.com

Source: youtube.com

In valuing currency of a country that uses multiple exchange rates use the rate that would apply if the currency in the account were converted into United. Ideally you would use the exchange rate on the date that each account hit its maximum value - though practically speaking you can use the annual average rate for 2020 the IRS publishes annual average rates - Yearly Average Currency Exchange Rates. TREASURY REPORTING RATES OF EXCHANGE. What was the average USD exchange rate in 2019. Dollar equivalents across all reporting done by agencies of the government.

Source: researchgate.net

Source: researchgate.net

Learn which FBAR Exchange Rate to use for preparing the FBAR FinCEN Form 114 Foreign Account Compliance. Learn which FBAR Exchange Rate to use for preparing the FBAR FinCEN Form 114 Foreign Account Compliance Currency exchange rates. FBAR Form 114 Report of Foreign Bank and Financial Accounts The Department of the Treasury has set the following exchange rates for your tax year 2020 FBAR and Form 8938. The annual average exchange rates are published by 1230 ET on the last business day of the year. Or 10000 CAD divided by 130 769230.

Source: irsstreamlinedprocedures.com

Source: irsstreamlinedprocedures.com

Dec 31 2020 2992B US1 httpswwwfiscaltreasurygovreports-statementstreasury-reporting-rates-exchangecurrenthtml. FBAR Exchange Rate for 2019 13000. An FBAR is not required to be filed if the person did not have 10000 of maximum value or aggregate maximum value in foreign financial accounts at any time during the calendar year. The annual average exchange rates are published by 1230 ET on the last business day of the year. Department Treasury 2020 FBAR Exchange Rate.

Source: forbes.com

Source: forbes.com

You dont file the FBAR with your federal tax return. Learn which FBAR Exchange Rate to use for preparing the FBAR FinCEN Form 114 Foreign Account Compliance Currency exchange rates. FBAR Form 114 Report of Foreign Bank and Financial Accounts The Department of the Treasury has set the following exchange rates for your tax year 2020 FBAR and Form 8938. Interest income and dividend income. What was the average USD CAD exchange rate in 2020.

Source: spg-pack.com

Source: spg-pack.com

TREASURY REPORTING RATES OF EXCHANGE. When do I use the. Jan 17 2020 Effective Date for Persons Involved in Transa. Exchange for the last day of the calendar year. FBAR Exchange Rate for 2017 12550.

Source:

Department Treasury 2020 FBAR Exchange Rate. Feb 10 2020 Password length Update XML Batch Validation. The Internal Revenue Service has no official exchange rate. Real estate should not be included. FBAR Department of Treasury Exchange Rates 2020 While Taxpayers are not required to use these exchange rates oftentimes the Department of Treasury Exchange rates are used for translating currency on forms such as the FBAR FinCEN Form 114 and IRS Form 8938 Foreign Account Tax Compliance Act the latter which is filed with the IRS.

Source: researchgate.net

Department Treasury 2020 FBAR Exchange Rate. Department Treasury 2020 FBAR Exchange Rate. The amount 1526525 would be recorded as 15266. If no Treasury Financial Management Service rate is available use another verifiable exchange rate and provide the source of that rate. Generally it accepts any posted exchange rate that is used consistently.

Source: taxbit.com

Source: taxbit.com

What was the average USD exchange rate in 2019. Starting in 2013 the. What was the average USD CAD exchange rate in 2020. Foreign Currency to 100. It is revised yearly to reflect the typical cash exchange rates for the listed countries and years.

Source: sdw.ecb.europa.eu

FBAR Exchange Rate for 2016 13460. Starting in 2013 the. Government has an interest including. FBAR and Form 8938. You must convert the maximum account value for each account into United States dollars using the Treasury year-end exchange rate.

Source: elibrary.imf.org

Source: elibrary.imf.org

FBAR Exchange Rate 2020 2019 2018 and before. If no Treasury Financial Management Service rate is available use another verifiable exchange rate and provide the source of that rate. What was the average USD exchange rate in 2019. In valuing currency of a country that uses multiple exchange rates use the rate that would apply if the currency in the account were converted into United. FBAR Exchange Rate for 2017 12550.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

If no Treasury Financial Management Service rate is available use another verifiable exchange rate and provide the source of that rate. FBAR Exchange Rate for 2016 13460. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Foreign Currency To 100. FBAR Exchange Rate 2020 2019 2018 and before.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fbar exchange rate 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.