Your Vertical spread option strategy news are available. Vertical spread option strategy are a wallet that is most popular and liked by everyone this time. You can Find and Download the Vertical spread option strategy files here. Download all royalty-free mining.

If you’re searching for vertical spread option strategy pictures information connected with to the vertical spread option strategy interest, you have come to the right blog. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Vertical Spread Option Strategy. A vertical spread is an options strategy that requires the following. The net effect is a credit received on opening that spread. A short vertical spread is a short option position credit with an additional long position debit to act as a hedge. Vertical Spread Option Strategies.

Option Trading Strategies Option Strategies Options Trading Strategies Stock Options Trading From pinterest.com

Option Trading Strategies Option Strategies Options Trading Strategies Stock Options Trading From pinterest.com

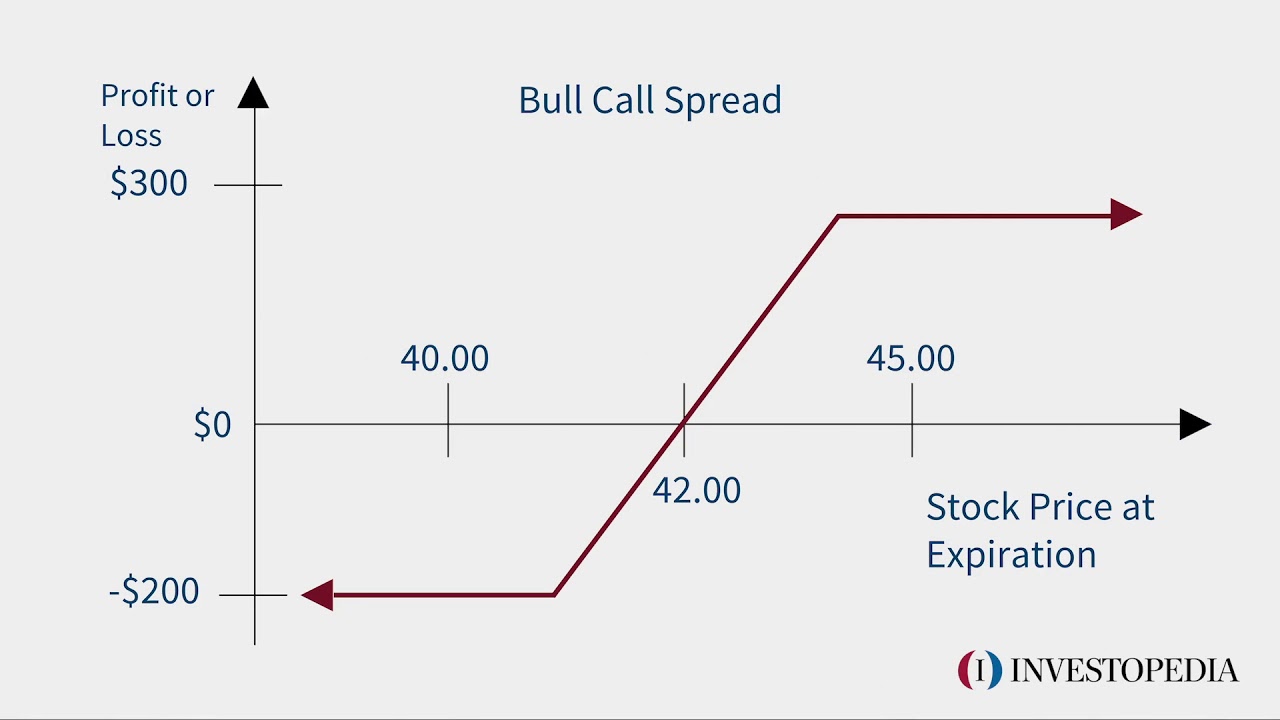

Vertical Spread Option Strategies. A call debit spread is a position in which you buy a call option and sell a call option at different strike prices using the same expiration date. A vertical spread options strategy is a combination of bought or sold options of the same underlying security and expiry date but different strike prices. Take Apple AAPL which reports Thursday afternoon. Lets break down each of the vertical spread option strategies in detail. A call vertical spread consists of buying and selling call options at different strike prices in the same expiration while a put vertical spread consists of buying and selling put options at different strike prices in the same expiration.

What is a Call Debit Spread.

When should this strategy be used. A short vertical spread is a short option position credit with an additional long position debit to act as a hedge. How Do I Choose The Best Vertical Spread Option Strategy. Vertical spread is an option spread strategy whereby an option trader purchases a certain number of options and simultaneously sells an equal number of options of the same class same underlying security same expiration date but at a different strike price. Bullish or bearish the vertical spread is one of the most simple and effective options strategies. I personally only select options that match my trading plan.

Source: pinterest.com

Source: pinterest.com

1 You need to know which options to trade. But different strike prices. Bull Call Spread Bear Call Spread Bull Put Spread and Bear Put Spread. Lets break down each of the vertical spread option strategies in detail and look at examples in Tasty Trade. Vertical spread is an option spread strategy whereby an option trader purchases a certain number of options and simultaneously sells an equal number of options of the same class same underlying security same expiration date but at a different strike price.

Source: pinterest.com

Source: pinterest.com

April 9 2015 By Jeff White. When should this strategy be used. A vertical spread is simply the purchase of an option and simultaneous sale of another option at different strike prices same underlying security of course. We consider each of these options trading strategies. On the options chain these positions appear vertically stacked hence the name vertical spread.

Source: pinterest.com

Source: pinterest.com

When should this strategy be used. A call debit spread is a position in which you buy a call option and sell a call option at different strike prices using the. Take Apple AAPL which reports Thursday afternoon. Lets break down each of the vertical spread option strategies in detail and look at examples in Tasty Trade. How Do I Choose The Best Vertical Spread Option Strategy.

Source: pinterest.com

Source: pinterest.com

There are various ways to construct different strategies but I have explained the most popular and best options strategies. A vertical spread is a known as a directional spread because it makes or loses money depending. With the vertical spread a player purchases an option as they sell another one simultaneously through calls or puts. The answer is by purchasing one option near the money and selling another strike further away. Youve probably heard me say it a million times if youve heard it once There are 3 things you need to know to be successful at trading.

Source: pinterest.com

Source: pinterest.com

How Do I Choose The Best Vertical Spread Option Strategy. Take Apple AAPL which reports Thursday afternoon. April 9 2015 By Jeff White. There are four basic types of vertical spread strategies. Bull Call Spread Bear Call Spread Bull Put Spread and Bear Put Spread.

Source: pinterest.com

Source: pinterest.com

Lets break down each of the vertical spread option strategies in detail and look at examples in Tasty Trade. Vertical spread is an option spread strategy whereby an option trader purchases a certain number of options and simultaneously sells an equal number of options of the same class same underlying security same expiration date but at a different strike price. Buying and selling options of the same type Calls or Puts. Lets break down each of the vertical spread option strategies in detail. How Do I Choose The Best Vertical Spread Option Strategy.

Source: pinterest.com

Source: pinterest.com

Lets break down each of the vertical spread option strategies in detail and look at examples in Tasty Trade. There are call vertical spreads and put vertical spreads. A call debit spread is a position in which you buy a call option and sell a call option at different strike prices using the. I personally only select options that match my trading plan. FREE OPTIONS TRADING MASTERCLASS httpsskyviewtradingco3BTtZjkThe Short Vertical Spread aka Vertical Credit Spread is the most basic options trad.

Source: pinterest.com

Source: pinterest.com

We consider each of these options trading strategies. Youve probably heard me say it a million times if youve heard it once There are 3 things you need to know to be successful at trading. April 9 2015 By Jeff White. We can distinguish four types of vertical spread options strategies. Purchase the 50 put at 230 Simultaneously write the 45 put at 070 Net Debit 160 ABC stock price 51.

Source: pinterest.com

Source: pinterest.com

How Do I Choose The Best Vertical Spread Option Strategy. You pay a debit up front with the potential to earn much more later. A short vertical spread is a short option position credit with an additional long position debit to act as a hedge. Vertical Spread Option Strategies. Call Debit Spread.

Source: pinterest.com

Source: pinterest.com

The answer is by purchasing one option near the money and selling another strike further away. Vertical Spread Option Strategies. Youve probably heard me say it a million times if youve heard it once There are 3 things you need to know to be successful at trading. FREE OPTIONS TRADING MASTERCLASS httpsskyviewtradingco3BTtZjkThe Short Vertical Spread aka Vertical Credit Spread is the most basic options trad. Learn the vertical spread options strategies in this comprehensive 11-part video seriesIn this video we start with a basic introduction to vertical spreads.

Source: pinterest.com

Source: pinterest.com

To establish this spread. A vertical spread is a known as a directional spread because it makes or loses money depending. April 9 2015 By Jeff White. A short vertical spread is a short option position credit with an additional long position debit to act as a hedge. Learn the vertical spread options strategies in this comprehensive 11-part video seriesIn this video we start with a basic introduction to vertical spreads.

Source: pinterest.com

Source: pinterest.com

Take Apple AAPL which reports Thursday afternoon. The vertical spread is an option spread strategy whereby the option trader purchases a certain number of options and simultaneously sell an equal number of options of the same class same underlying security same expiration date but at a different strike price. Since option spreads involve one long and one short position they are affected less by time decay movement in the underlying price and changes in volatility. April 9 2015 By Jeff White. Buying and selling options of the same type Calls or Puts.

Source: pinterest.com

Source: pinterest.com

April 9 2015 By Jeff White. A call vertical spread consists of buying and selling call options at different strike prices in the same expiration while a put vertical spread consists of buying and selling put options at different strike prices in the same expiration. When should this strategy be used. A call debit spread is a position in which you buy a call option and sell a call option at different strike prices using the same expiration date. Youve probably heard me say it a million times if youve heard it once There are 3 things you need to know to be successful at trading.

Source: pinterest.com

Source: pinterest.com

There are four basic types of vertical spread strategies. A vertical spread is simply the purchase of an option and simultaneous sale of another option at different strike prices same underlying security of course. Lets break down each of the vertical spread option strategies in detail. Purchase the 50 put at 230 Simultaneously write the 45 put at 070 Net Debit 160 ABC stock price 51. But different strike prices.

Source: pinterest.com

Source: pinterest.com

I personally only select options that match my trading plan. A vertical spread is a known as a directional spread because it makes or loses money depending. FREE OPTIONS TRADING MASTERCLASS httpsskyviewtradingco3BTtZjkThe Short Vertical Spread aka Vertical Credit Spread is the most basic options trad. The investor who has initiated the 5045 Bear Put Spread has obtained the right to sell ABC at 50 and has assumed the obligation to buy ABC at 45 if assigned. What is a Call Debit Spread.

Source: pinterest.com

Source: pinterest.com

Vertical spread is an option spread strategy whereby an option trader purchases a certain number of options and simultaneously sells an equal number of options of the same class same underlying security same expiration date but at a different strike price. What is a Call Debit Spread. Lets break down each of the vertical spread option strategies in detail and look at examples in Tasty Trade. To establish this spread. FREE OPTIONS TRADING MASTERCLASS httpsskyviewtradingco3BTtZjkThe Short Vertical Spread aka Vertical Credit Spread is the most basic options trad.

Source: pinterest.com

Source: pinterest.com

A vertical spread is an options strategy that requires the following. Purchase the 50 put at 230 Simultaneously write the 45 put at 070 Net Debit 160 ABC stock price 51. Lets break down each of the vertical spread option strategies in detail. The vertical spread is an option spread strategy whereby the option trader purchases a certain number of options and simultaneously sell an equal number of options of the same class same underlying security same expiration date but at a different strike price. A vertical spread is simply the purchase of an option and simultaneous sale of another option at different strike prices same underlying security of course.

Source: pinterest.com

Source: pinterest.com

There are various ways to construct different strategies but I have explained the most popular and best options strategies. Learn the vertical spread options strategies in this comprehensive 11-part video seriesIn this video we start with a basic introduction to vertical spreads. Since option spreads involve one long and one short position they are affected less by time decay movement in the underlying price and changes in volatility. There are four basic types of vertical spread strategies. You pay a debit up front with the potential to earn much more later.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vertical spread option strategy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.