Your Vertical spread robinhood exchange are available in this site. Vertical spread robinhood are a mining that is most popular and liked by everyone now. You can News the Vertical spread robinhood files here. News all royalty-free wallet.

If you’re searching for vertical spread robinhood pictures information related to the vertical spread robinhood interest, you have visit the right blog. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

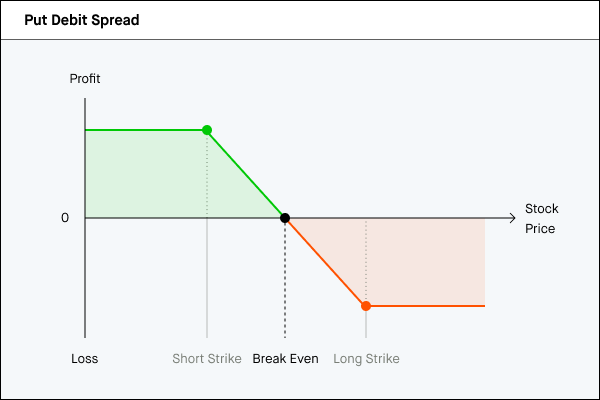

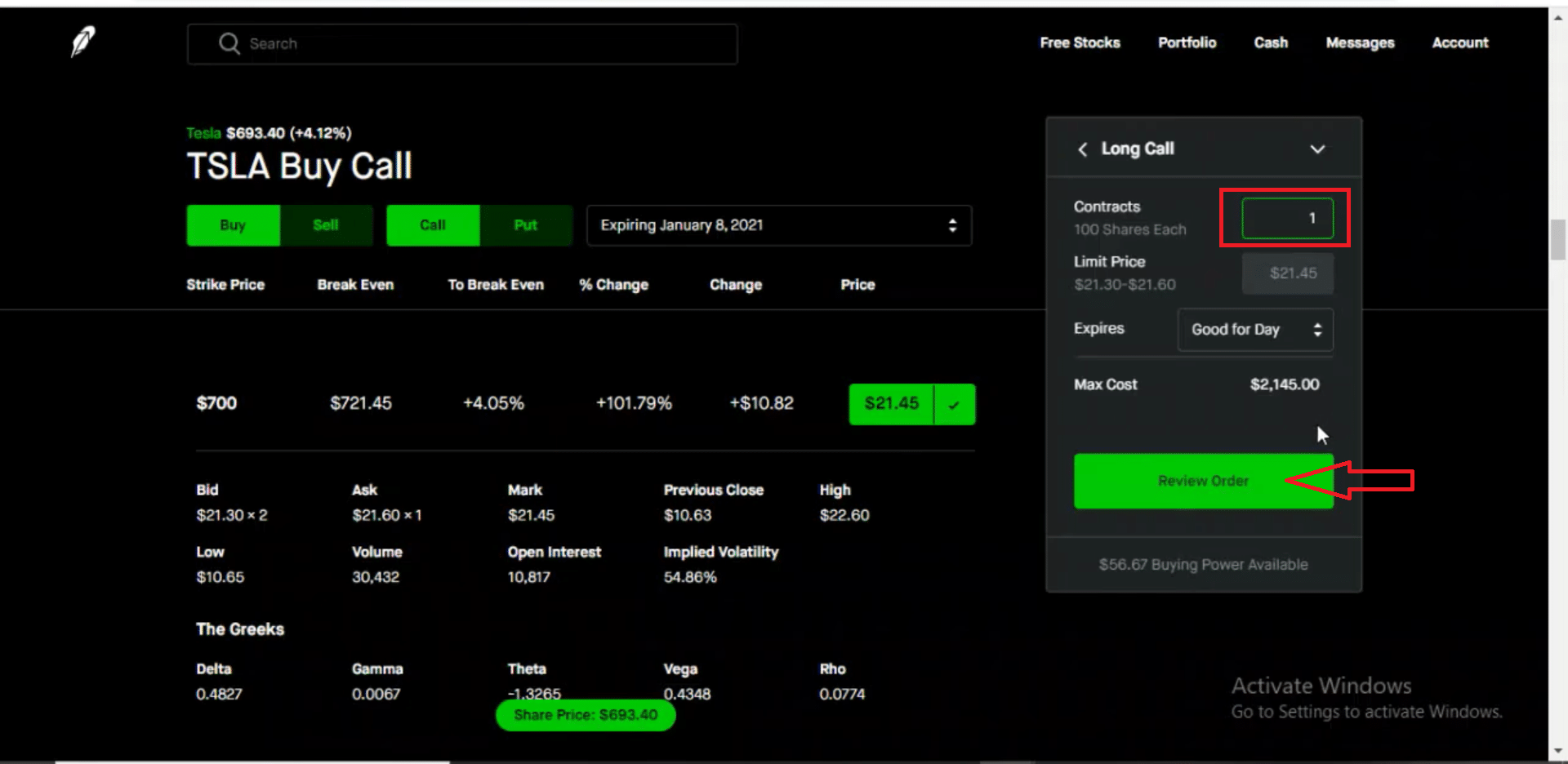

Vertical Spread Robinhood. I dont recommend entering all 4 at once because that can be confusing. We can distinguish four types of vertical. ET the closing bell for the stock market on the contracts expiration date. Spreads often get a bad rap for sounding more complex than they end up being.

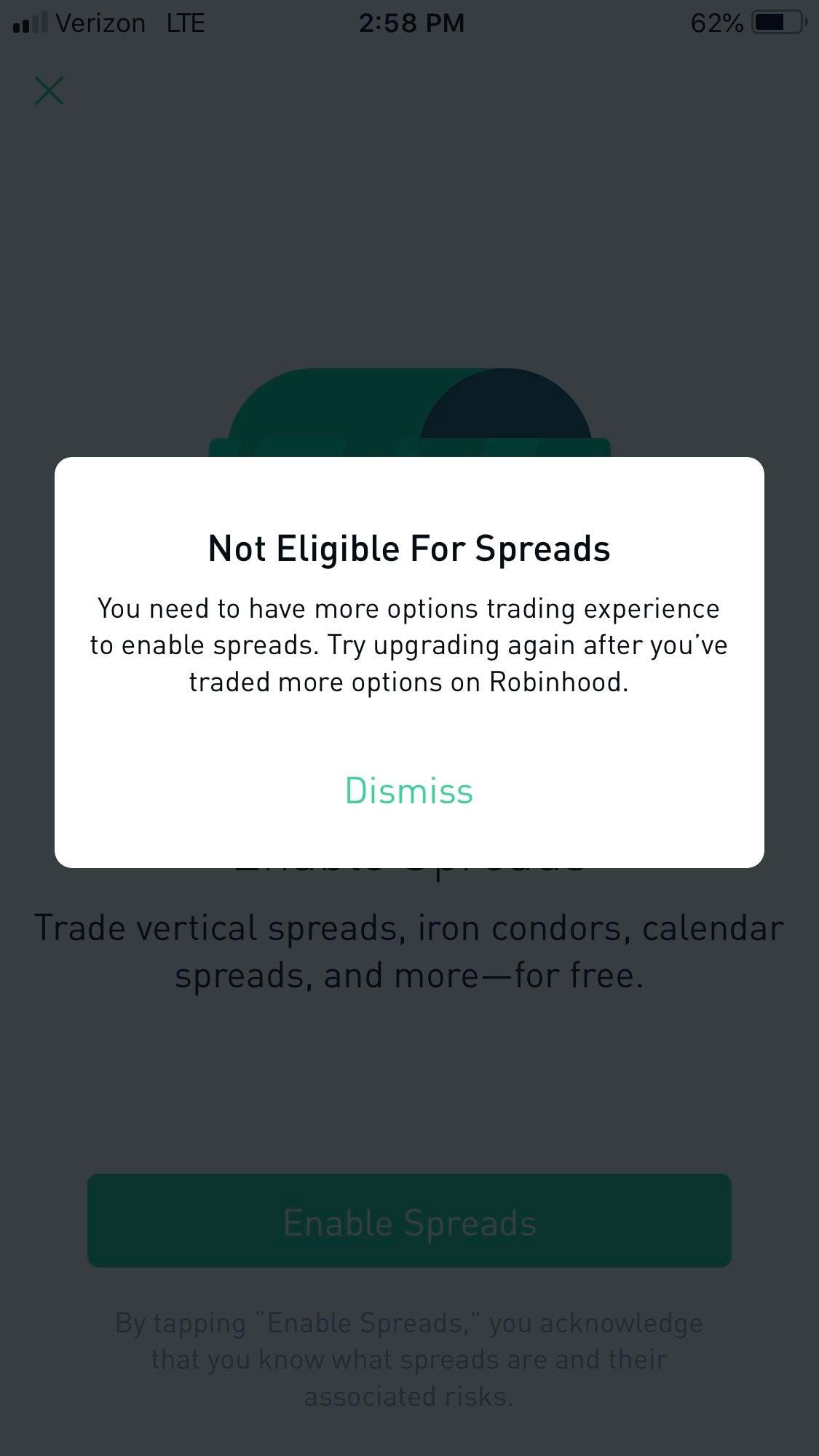

Vertical Spread Basics. Arrange them in a way that. This is a directional strategy. You must do it yourself. Would robinhood just handle the execution and leave your profit which is what ETrade does known as a Cashless Execution of a Debit Spread or would they first require you to buy the shares at the 9 strike and then sell at the 10 strike meaning youd need to have the cash on hand to first purchase the 9 call. Cryptocurrency trading is offered through an account with Robinhood Crypto.

Past videos on this trading strategy and credit spreads.

Cryptocurrency trading is offered through an account with Robinhood Crypto. Remember Robinhood options fulfillment is poor at best. Either close your current position and then open another or in the case of a vertical spread you can enter all 4 orders at once. However because youre buying and selling a contract youre more protected. Cryptocurrency trading is offered through an account with Robinhood Crypto. If you send a market order it will likely be executed closer to 295 and you will lose out on the extra 5.

Source: reddit.com

Source: reddit.com

If the the stock goes above 220 then you have maxed your profits and should have a value of 1900. But different strike prices. Would robinhood just handle the execution and leave your profit which is what ETrade does known as a Cashless Execution of a Debit Spread or would they first require you to buy the shares at the 9 strike and then sell at the 10 strike meaning youd need to have the cash on hand to first purchase the 9 call. Spreads often get a bad rap for sounding more complex than they end up being. As a result you must choose the right direction.

Source: reddit.com

Source: reddit.com

ET the closing bell for the stock market on the contracts expiration date. On the options chain these positions appear vertically stacked hence the name vertical spread. We can distinguish four types of vertical. Arrange them in a way that. As a result you must choose the right direction.

Source: medium.com

Source: medium.com

If the the stock goes above 220 then you have maxed your profits and should have a value of 1900. Question about debit spread. My defined risk is 1000 200-190100. According to Robinhood you can close any spread until 400 pm. Advanced Options Strategies Level 3 Although options may not be appropriate for everyone they can be among the most flexible of investment choices.

Source: amazon.com

Source: amazon.com

An options trading strategy with which a trader makes a simultaneous purchase and sale of two options of the same type that have. Is there a button or do I have to buy and sell in two different purchases. This page is an educational tool that can help you learn about. This is a directional strategy. For this spread Im getting a credit of 12000 dollars.

Source: blog.robinhood.com

Source: blog.robinhood.com

ET the closing bell for the stock market on the contracts expiration date. A vertical spread is an options strategy that requires the following. Money is initially debited from your account resulting in the debit spread name. Buy call at 200 for 20 Sell call at 220 for 10. Id wager quite a few people here dont even know what the Select button is for at the top right of the options screen on Robinhood.

Source: blog.robinhood.com

Source: blog.robinhood.com

Is there a button or do I have to buy and sell in two different purchases. The other components of vertical spreads is the debit spread. This is a directional strategy. Answer 1 of 3. Vertical Spread How to make money trading a vertical spread.

Source: reddit.com

Source: reddit.com

The other components of vertical spreads is the debit spread. This thread is archived. Remember Robinhood options fulfillment is poor at best. On the options chain these positions appear vertically stacked hence the name vertical spread. A vertical spread is an options strategy that requires the following.

Source: leaprate.com

Source: leaprate.com

Arrange them in a way that. ET the closing bell for the stock market on the contracts expiration date. However because youre buying and selling a contract youre more protected. If the the stock goes above 220 then you have maxed your profits and should have a value of 1900. Money is initially debited from your account resulting in the debit spread name.

Source: youtube.com

Source: youtube.com

Probability of profit based on historical data is 80. Probability of profit based on historical data is 80. The other components of vertical spreads is the debit spread. Cryptocurrency trading is offered through an account with Robinhood Crypto. This thread is archived.

Source: youtube.com

Source: youtube.com

So 120 credit1000 risked 12 ROI on collateral. Question about debit spread. This is a directional strategy. The Bull Put Spread also known as Put Credit Spreads involves simultaneously selling a put option and purchasing a put option of lower strike. Bull Put Spread.

Source: reddit.com

Source: reddit.com

ET the closing bell for the stock market on the contracts expiration date. But different strike prices. An options trading strategy with which a trader makes a simultaneous purchase and sale of two options of the same type that have. Buy call at 200 for 20 Sell call at 220 for 10. Advanced Options Strategies Level 3 Although options may not be appropriate for everyone they can be among the most flexible of investment choices.

But different strike prices. How To Make Money Trading Options The Vertical Spread stockmarketforbeginnersoptionstradingstockmarketdeepakzbrooptionstradertoday Read more related postsHow To Make Money Trading Options. Im sure this has been asked before many times before so forgive me. Vertical Spread Basics. We can distinguish four types of vertical.

Source: learn.robinhood.com

Source: learn.robinhood.com

On the options chain these positions appear vertically stacked hence the name vertical spread. If I buy a debit spread for xyz where. If the the stock goes above 220 then you have maxed your profits and should have a value of 1900. Arrange them in a way that. Could someone explain how to do vertical spread option trading on Robinhood.

Source: youtube.com

Source: youtube.com

Either close your current position and then open another or in the case of a vertical spread you can enter all 4 orders at once. If you send a market order it will likely be executed closer to 295 and you will lose out on the extra 5. Id wager quite a few people here dont even know what the Select button is for at the top right of the options screen on Robinhood. Vertical Spread How to make money trading a vertical spread. This strategy is now banned by Robinhood read the link in my comment below for more info This technique is still possible by entering an escalating series of Credit Spreads.

Source: marketxls.com

Source: marketxls.com

Bull Put Spread. Probability of profit based on historical data is 80. As a result you must choose the right direction. Either close your current position and then open another or in the case of a vertical spread you can enter all 4 orders at once. A vertical spread is an options strategy that requires the following.

Source: youtube.com

Source: youtube.com

Id wager quite a few people here dont even know what the Select button is for at the top right of the options screen on Robinhood. Arrange them in a way that. If you send a market order it will likely be executed closer to 295 and you will lose out on the extra 5. Buying and selling options of the same type Calls or Puts. Buy call at 200 for 20 Sell call at 220 for 10.

Source: youtube.com

Source: youtube.com

Either close your current position and then open another or in the case of a vertical spread you can enter all 4 orders at once. If I buy a debit spread for xyz where. If the the stock goes above 220 then you have maxed your profits and should have a value of 1900. This strategy is now banned by Robinhood read the link in my comment below for more info This technique is still possible by entering an escalating series of Credit Spreads. Vertical Spread How to make money trading a vertical spread.

Source: publicfinanceinternational.org

Source: publicfinanceinternational.org

The Bull Put Spread also known as Put Credit Spreads involves simultaneously selling a put option and purchasing a put option of lower strike. Cryptocurrency trading is offered through an account with Robinhood Crypto. You must do it yourself. Buying and selling options of the same type Calls or Puts. Either close your current position and then open another or in the case of a vertical spread you can enter all 4 orders at once.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vertical spread robinhood by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.