Your Volatility 100 index strategy trading are available. Volatility 100 index strategy are a trading that is most popular and liked by everyone this time. You can Download the Volatility 100 index strategy files here. News all free trading.

If you’re looking for volatility 100 index strategy pictures information linked to the volatility 100 index strategy topic, you have pay a visit to the ideal blog. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

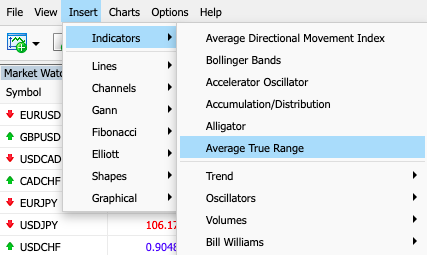

Volatility 100 Index Strategy. This strategy is a combination of three Meta Trader 5 indicators. Subscribe to my Youtube Channel. This 10000000 points per trade based on observation. The maximum drop from peak to valley over 5 years of NASDAQ 100 Low Volatility Sub-strategy is -285 days which is higher thus better compared to the benchmark QQQ -286 days in the same period.

Synthetic Indices From tradingdot.com

Synthetic Indices From tradingdot.com

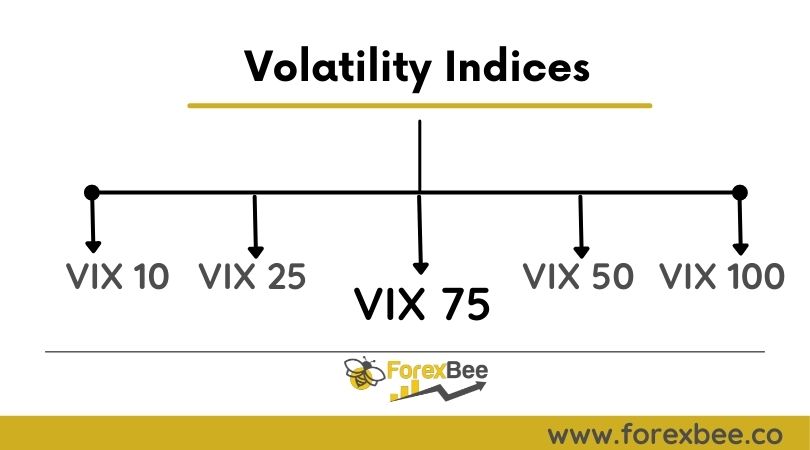

It was created by CBOE Chicago board options exchange in 1993 for the SP 500 Index.

Basically the indicators are Moving averages Relative Strength Index Ichimoku and Envelopes. Here we use m and w plus rejections. Please try this strategy on a demo. BeanFX Volatility 100 Index Scalper will assist Volatility Index 100 traders on how to scalp quick profits when trading Volatility index 100. But simple or complex what all strategies have in common is that theyre based on two fundamental option types. At the other end of the spectrum the Volatility 100 Index is set at 100 so you will see fairly violent swings in prices which some systems and traders prefer.

Source: beanfxtrader.com

Source: beanfxtrader.com

This 10000000 points per trade based on observation. We released UNDISPUTED KILLER PIPS 2021 Strategy for trading Volatility Indices which is working even for step index boom and crash and also a new jump index offered by our recommend broker Deriv. There is a separate guide on how to calculate the number of pips on Volatility 75 Index. Do you know you can start making money with Volatility 75 even as a complete newbie. It moves with a straight line shaped movement from top to bottom.

Source: forexbee.co

Source: forexbee.co

This 10000000 points per trade based on observation. Binary Options Volatility 100 1s Index Deriv Mt5 Meta Trading Strategy - Career - Nigeria. You can start with minimum amount 035. You must monitor 1 and 2 to determine when to opt out of a trade prematurely. Trading Synthetic Indices on DTrader On Deriv.

Source: tradingview.com

Source: tradingview.com

It is not a measure of the current volatility in the market although as we shall see it is related. You can start with minimum amount 035. If you are wondering about what kind of strategies we are using to trade Indices on. Binary Options Volatility 100 1s Index Deriv Mt5 Meta Trading Strategy - Career - Nigeria. At the other end of the spectrum the Volatility 100 Index is set at 100 so you will see fairly violent swings in prices which some systems and traders prefer.

Source: pinterest.com

Source: pinterest.com

The VIX is the Chicago Board Options Exchange Market Volatility Index CBOE 2009. So do not use those on vix. You must monitor 1 and 2 to determine when to opt out of a trade prematurely. Before run any bots in your real account you have to test all bots what you get first of all run in your demo account. The Volatility 10 Index has volatility set at 10 so the range of price movements will be lower.

Source: motivation.africa

Source: motivation.africa

The VIX is the Chicago Board Options Exchange Market Volatility Index CBOE 2009. Below weve provided some examples of volatility systems using breakouts and options trading. In other words this implies AMZN stock prices will range between 1600 and 2400 over the next year. Since then the VIX is commonly used as a gauge of US. We released UNDISPUTED KILLER PIPS 2021 Strategy for trading Volatility Indices which is working even for step index boom and crash and also a new jump index offered by our recommend broker Deriv.

Source: beanfxtrader.com

Source: beanfxtrader.com

The Volatility Index or VIX is a market index that represents the markets volatility of the next 30 days. I personally target 100 pips per trade irrespective of the movement. The maximum drop from peak to valley over 5 years of NASDAQ 100 Low Volatility Sub-strategy is -285 days which is higher thus better compared to the benchmark QQQ -286 days in the same period. This 10000000 points per trade based on observation. Vice versa for BUY.

![]() Source: forex.in.rs

Source: forex.in.rs

Vice versa for BUY. See more on advanced chart. You must monitor 1 and 2 to determine when to opt out of a trade prematurely. Many people wonder how to use volatility in trading. Do you know you can start making money with Volatility 75 even as a complete newbie.

Source: daytrading.com

Source: daytrading.com

Looking at maximum DrawDown in of -285 days in the period of the last 3 years we see it is relatively larger thus better in comparison to QQQ -286 days. I personally target 100 pips per trade irrespective of the movement. The maximum drop from peak to valley over 5 years of NASDAQ 100 Low Volatility Sub-strategy is -285 days which is higher thus better compared to the benchmark QQQ -286 days in the same period. This 10000000 points per trade based on observation. At the other end of the spectrum the Volatility 100 Index is set at 100 so you will see fairly violent swings in prices which some systems and traders prefer.

Source: in.pinterest.com

Source: in.pinterest.com

Basically the indicators are Moving averages Bollinger Bands and MACD. There is a separate guide on how to calculate the number of pips on Volatility 75 Index. BeanFX Volatility 100 Index Scalper will assist Volatility Index 100 traders on how to scalp quick profits when trading Volatility index 100. Volatility 100 Index V100 Index. I personally target 100 pips per trade irrespective of the movement.

Source: pinterest.com

Source: pinterest.com

Vix always manipulate many forex patterns and knowledge like support and resistance flags and edges etc. Do you know you can start making money with Volatility 75 even as a complete newbie. Looking at maximum DrawDown in of -285 days in the period of the last 3 years we see it is relatively larger thus better in comparison to QQQ -286 days. These are some of the most popular ways you can trade volatility though its ultimately up to you to decide what works best. It is not a measure of the current volatility in the market although as we shall see it is related.

Source: tradingdot.com

Source: tradingdot.com

Since then the VIX is commonly used as a gauge of US. This strategy will help you maximize the opportunities that volatility 100 offers in the market build up your account to a very high levelWe uses Simple Mo. Index and Bull Market Index. These are some of the most popular ways you can trade volatility though its ultimately up to you to decide what works best. This article will assist Volatility Index 75 traders on how to scalp quick profits when trading Volatility index 75.

Source: pinterest.com

Source: pinterest.com

But simple or complex what all strategies have in common is that theyre based on two fundamental option types. If you are wondering about what kind of strategies we are using to trade Indices on. The Volatility Index or VIX is a market index that represents the markets volatility of the next 30 days. You must monitor 1 and 2 to determine when to opt out of a trade prematurely. Vice versa for BUY.

Source: beanfxtrader.com

Source: beanfxtrader.com

Vice versa for BUY. Vice versa for BUY. Do you know you can start making money with Volatility 75 even as a complete newbie. The ideal time frame for this strategy are 15 mins and 30 mins time frames. It was created by CBOE Chicago board options exchange in 1993 for the SP 500 Index.

Source: investopedia.com

Source: investopedia.com

The strategy can be used to trade the volatility index on different time frames. Many people wonder how to use volatility in trading. The strategy can be used to trade the volatility index on different time frames. 023 139 Market Closed as of Nov 18 1846 GMT9 1651. It is an index that is in some sense a measure of the markets expectation of the average volatility over the next 30 days.

Source: swagforex.com

Source: swagforex.com

It is not a measure of the current volatility in the market although as we shall see it is related. Volatility 100 Index V100 Index. BeanFX Volatility 100 Index Scalper will assist Volatility Index 100 traders on how to scalp quick profits when trading Volatility index 100. But simple or complex what all strategies have in common is that theyre based on two fundamental option types. The DTrader be accessed via Derivapp on a desktop or a mobile device on a browser.

Source: swagforex.com

Source: swagforex.com

Do you know you can start making money with Volatility 75 even as a complete newbie. This 10000000 points per trade based on observation. The ideal time frame for this strategy are 15 mins and 30 mins time frames. The Volatility 100 Index is twice as volatile as the. This strategy showed the best results for the following.

Source: pinterest.com

Source: pinterest.com

So do not use those on vix. Many people wonder how to use volatility in trading. Volatility index 100 trading strategies pdf Options trading strategies run the gamut from simple one-legged trades to exotic multilegged beasts that seem like theyve emerged from a fantasy novel. Check for few hours and set. It is not a measure of the current volatility in the market although as we shall see it is related.

Source: pinterest.com

Source: pinterest.com

BeanFX Volatility 100 Index Scalper will assist Volatility Index 100 traders on how to scalp quick profits when trading Volatility index 100. Below weve provided some examples of volatility systems using breakouts and options trading. This strategy uses currency pairs and has a success rate of 75. Since then the VIX is commonly used as a gauge of US. The DTrader be accessed via Derivapp on a desktop or a mobile device on a browser.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title volatility 100 index strategy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.